Want to make your company carbon neutral?

Start with APLANET NEUTRALITY

Our platform helps you to align with the GHG Protocol and climate neutrality to reach your measurement and decarbonisation goals.

Key benefits of

APLANET NEUTRALITY

- Calculation of GHG Emissions

- Use of pre-loaded standards such as GHG Protocol and possibility to create customised indicators as needed

- Self-calculated intensity indicators, based on data already filled in the platform, e.g. emissions per employee, square metre, monetary unit, etc.

- Synchronisation with APlanet Sustainability (ESG data management platform)

- DEFRA factors are pre-loaded in the platform and possibility to customise values as needed. Emission factors have different values per period and country.

Problema

Solución APLANET NEUTRALITY

Detailed representation of organisational structure in multiple dependencies

Neutrality allows you to flexibly represent your organisational structure. At the same time, you will be able to visualise your data individually, by node, or in an aggregated way.

Neutrality offers a series of preloaded indicators that include several categories of both direct and indirect emissions, thus facilitating data collection.

I need custom calculations and special ratios adapted to my situation.

Our product offers the flexibility of being able to integrate the pre-loaded indicators with other custom ones to obtain the information at the level of detail you need.

I don’t know which emission factors to use to make my calculations

Neutrality offers pre-loaded and up-to-date emission factors to facilitate your trading and ensure reliable results.

I need to use additional emission factors adjusted to my current situation.

Preloaded values can be edited, keeping track of changes as well as adding new factors as needed.

I need to collect data from various sources.

Through external requests you can schedule and automate these requests.

I need to define objectives and monitor their evolution.

Neutrality allows you to define different objectives for each period of time and evaluate the variation of the current values with respect to them, in order to facilitate monitoring until reaching zero emissions.

I need to see all the summarised information

Our dashboards allow you to have an overview and then go into detail for all the data on the platform. You can also see the evolution between periods and the objectives proposed in each of them.

I need to validate the emissions data collected and present it to auditors.

Our product offers a validation flow to guarantee integrity and traceability of the information as well as access to auditors so they can see the base data and the evidence associated with each piece of data.

I need to share the reported information with external entities for auditing.

Our product allows auditors access to the platform to view and validate the information, as well as various methods to extract and share the information.

Business and climate action

Do you know how to prepare your company to take climate action?

In this «decade of action» or «make or break era», decarbonisation is at the centre of all climate policy agendas. What is done in the next 10 years will be decisive and issues such as the biodiversity crisis, climate change and social inequality will have a point of no return if we fail to act appropriately now.

From the business side, managing the multiple challenges of sustainability means measuring environmental impact and making a green transition.

Having a positive impact on the environment and society is essential for success and for your model to endure regardless of the size of your company. Achieving carbon neutrality or net zero is a challenge we can help you meet.

Do you still have doubts and don't know how to take action?

Sustainability and your ESG data in the cloud

With our platform you will always be up to date with sustainability standards and regulations. Get the most out of your company’s ESG data and make data-driven decisions. Measuring your organisation’s environmental impact is more important than ever to drive corporate commitments to sustainable development.

Main advantages of APLANET:

Technical support

Mitigate risks

Understand impact by organisational area

Set targets

Customisation of KPIs

Simultaneous project management

National and international indicators and standards

Unlimited number of users

Dashboards for metrics tracking

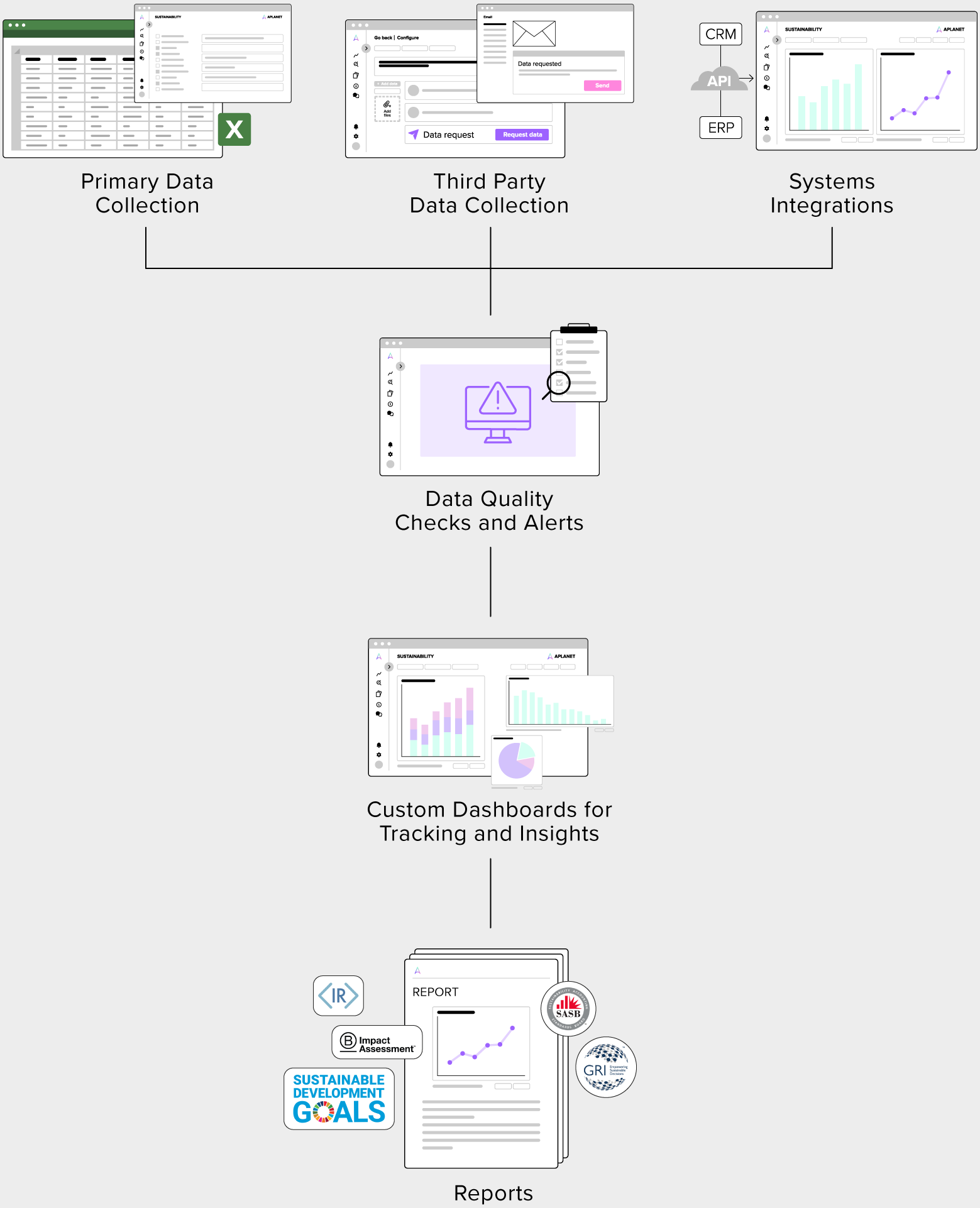

This is how our software works

We have a technology solution that has received numerous recognitions and awards.

Sustainability data management in the cloud is an innovative idea that combines two highly compatible worlds: sustainability and technology.

Using ESG software has numerous benefits: it is an authoritative source of data that collects and unifies information in order to report and make data-driven business decisions, as well as showcasing all of your company’s sustainability efforts.

This is what people who have integrated our software for the management of non-financial information in their company have to say:

“The value it brought us was more than just the technology itself, but that the tool offered us a more strategic way of dealing with sustainability.”

Felix Zamora,

General Director of IXOS

«APLANET’s tool reduces the time I spend chasing people and allows me to spend it on analysing the information gathered, which is the most important function. For me, as an analyst, the time I spend chasing information is not useful; my time should be spent analysing or questioning the data to see if it makes sense. For this reason, the benefit of the platform has been enormous.»

Cristina Silva,

Senior Environmental Analyst in Globo Group

“We recently presented APLANET to our board of directors and it was a success thanks to the ease of use and dashboard power of the tool.”

Rosa Esteban,

Grupo Sesé

«The APLANET tool is giving us the opportunity to interact with sustainability issues much more and to include different stakeholders within the organisation across different divisions. Now we know exactly who has the information and how to structure it. In addition, the platform has allowed us to unify concepts and distribute them from top to bottom.»

Gabriela Martín,

Global Risk and Compliance in Dominion

Did you know that by 2025 global ESG investment will be valued at $50 trillion*?

If your business is aligned with sustainability standards, you will find it easier to access credit lines, green, social and sustainable bonds.

Securing financing will be closely linked to the sustainability objectives your organisation aims to meet. Achieving sustainable development has become a priority in the financial sector. That is why 49% of investors consider divesting from companies that do not take sufficient ESG measures (PwC, 2022).

Whether you need to comply with international or national regulations, APLANET SUSTAINABILITY helps you to achieve your sustainability goals in a simple way.

*ESG May Surpass $41 Trillion Assets in 2022, But Not Without Challenges, Finds Bloomberg Intelligence / bloomberg.com